Washington County Property Owner: My wife and I own land in Washington County and are interested in a wildlife tax valuation/wildlife exemption. A neighboring landowner used your services this past spring, filed the documents but says he has not heard a thing from the Washington County Appraisal District. What happens after the paperwork is submitted? How would one know if the plan was accepted?

Wildlife Exemptions: No News is Good News

The fact that your neighbor has not heard anything from the local county appraisal district (CAD) is actually good news. Generally, an appraisal district only contacts someone if there is a problem, kind of like the IRS. This varies between counties because a few of them do send out letters letting property owners know that their management plans were accepted, but the overwhelming majority of Texas CADs are only going to contact a property owner if something is wrong.

So, in short, a landowner that has filed a sound management plan can consider themselves accepted, unless they hear otherwise. A property owner that does not hear back can either assume everything is going swimmingly or they can simply pick up the phone and give the CAD a call.

The spring of the year is generally busy for CADs since the deadline to file for a wildlife tax valuation, as well as other valuations and exemptions, is April 30 each year. Even if a property owner wanted to make that call, it would be best to wait until June as the very earliest. A property owner can also navigate to the CAD’s website, where most landowners can verify their current tax valuations.

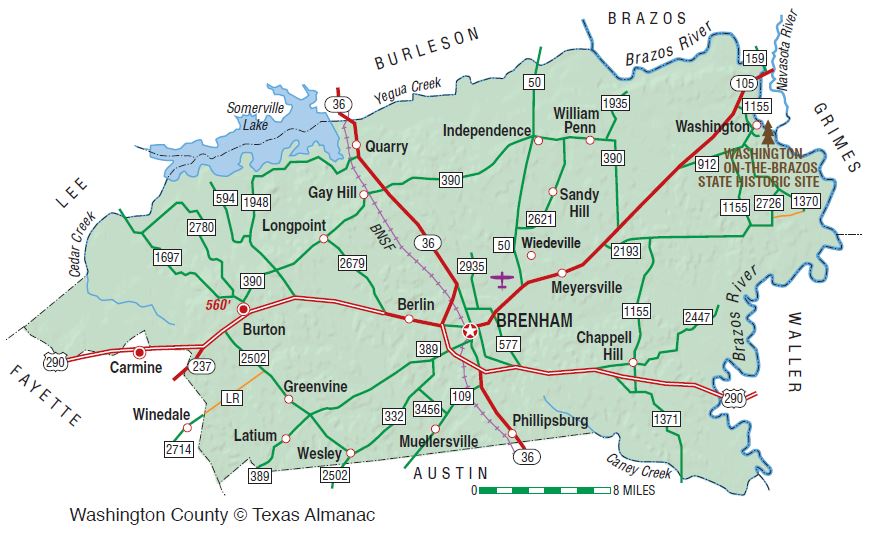

Wildlife Exemption Guidelines in Washington County

In Texas, an appraisal district will be primarily looking to see if a property meets the basic criteria for changing to wildlife, that the land is already appraised for ag use and the wildlife management plan states the property owner’s goals and the native wildlife species that are being managed and identifies the specific wildlife management practices and activities to be implemented that are consistent with guidelines for the ecoregion in which the property is located.

Reduction in Acreage: Washington County & Elsewhere

Other than the items mentioned above, Washington County and other CADs will check to see if the property has had a reduction in acreage since January 1 of the previous tax year. If the tract of land has been reduced in size from being cut out of a larger tract, subdivided, etc. then the land must meet the minimum size requirements for the ecoregion and county.

Considering a Wildlife Tax Valuation?

If you are the owner of rural property in Washington County (or any other county in Texas) and are thinking about switching from ag use to wildlife management use please considering contacting us. We specialize in management plans that are customized for specific properties and that meet or surpass the requirements used by the local county appraisal district. We let you know you up front whether you are eligible to convert to a wildlife exemption so that you do not waste your time or your money.