If you have recently purchased land in Texas and/or are applying for a wildlife tax valuation then you will need to complete Form 50-129 and file it with your local county appraisal district (CAD). This article provides Form 50-129 instructions for 1) property owners have purchased new land with an agricultural tax valuation, and 2) property owners that are changing held land from traditional agriculture to wildlife management use.

Under the Texas Constitution, actively managing for native wildlife is legally considered agriculture. This may be new information to some, but in 1995 Texas began allowing property owners to convert farm, ranch and timber lands to wildlife management use while retaining agricultural tax rates.

A wildlife tax valuation is often incorrectly referred to as a wildlife exemption, but property owners still pay taxes. It’s a great deal, however, for the owners of Texas property because their property’s annual taxes are based on production value of the land rather than the market value of the land.

Wildlife management use is also a good deal for Texas wildlife. The wildlife tax valuation in Texas was designed to be a conservation initiative, a way to maintain open, undeveloped areas across the state. In return for managing for Texas’ wildlife, property owners receive the benefit of ag-based taxes.

The law, however, restricts the land that may qualify for wildlife management use. To qualify for agricultural appraisal under the wildlife management use, land must be qualified for agricultural appraisal under Tax Code Chapter 23, Subchapter D, (1-d-1 or open space agricultural appraisal), at the time the owner changes use to wildlife management use. Property owners must submit Form 50-129 and a wildlife management plan that details the native wildlife managed for and the specific management practices that will occur on the property.

Form 50-129 Instructions

This form is required when initially applying for agricultural use or for a change in the type of agricultural use. If you recently purchased land used for farming, ranching or for other commercial agricultural operations then you will need to form this file with the central appraisal district in the county where the land is found.

Unless instructed otherwise by the CAD, this form should only be filed between January 2 and April 30 of the year in which you intend to apply. If you close on (purchase) ag land after the standard enrollment period, then you do not need typically need to file this form until after the new year rolls around.

Any tax valuation held by an existing owner will be “locked-in” as of April 30, and new owners can only file changes once they are the owner of record on January 1 of the year in which they file. This is standard procedure, but if you do buy land and the local CAD does ask for a 50-129 application form, then by all means submit it.

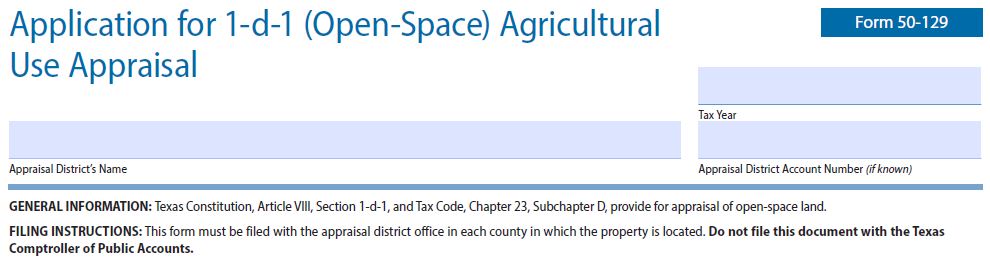

Page 1: Application for 1-d-1 Agricultural Use Appraisal

The very top section of Form 50-129 is only there to make sure your form ends up at the right appraisal district. Make sure you know where your property is located and send it to the appropriate CAD. Not much instruction needed here. Simply enter the tax year in which the application is being made, the county appraisal district’s name, and the account number for the property (if known).

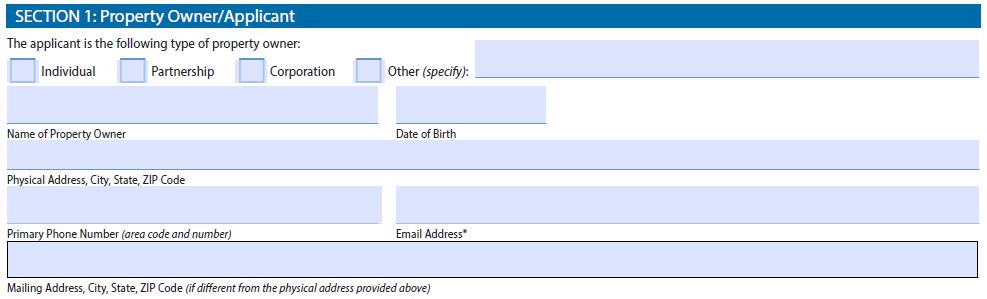

Form 50-129 Instructions: Section 1

The first section of this form is to notify the CAD of who is making an application for change in use appraisal. First, select the appropriate type of owner. Most will apply as an individual but make sure to choose partnership or corporation if the property is held by such an entity. Next, provide all the necessary contact information.

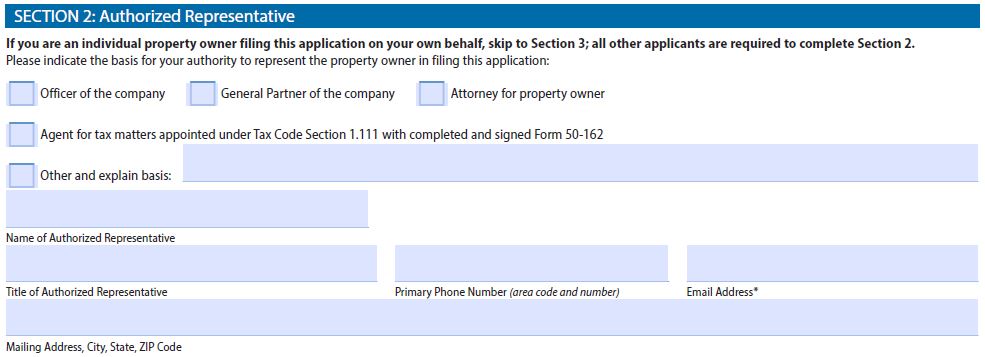

Form 50-129 Instructions: Section 2

If you are reading this Form 50-129 guide, then Section 2 will most likely be left blank. This section is for individuals or companies that are representing the actual property owners to the appraisal district. If this is the case, this section simply collects the necessary contact information. Leave this section blank if you this application is being made for your own property.

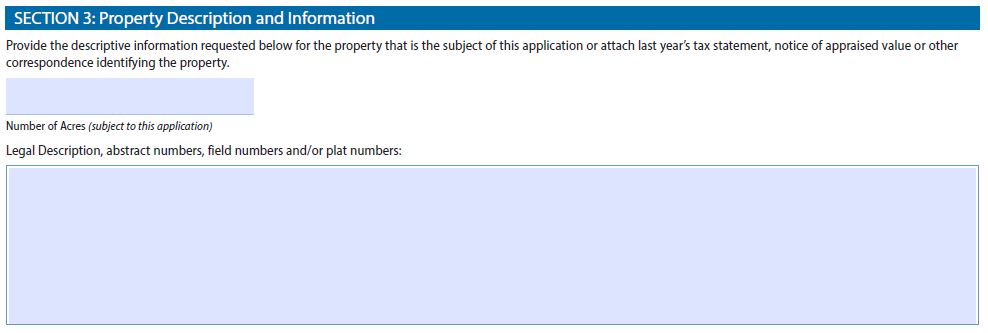

Section 3: Form 50-129 Instructions

The third section of the form is designed to identify the specific tract of land for which a proposed change in land use applies. It asks to provide descriptive information regarding the property that is subject to application.

If this property has been under your ownership for some time then you can provide your account identification number as well as the legal description of the property (which typically includes abstract names and numbers and or tract or plat numbers.) You can get this information from documents that you received at the time of sale or you can navigate to the CAD’s web site and find the necessary information.

The image above is generally how an account on a CAD web site appears. Notice that it offers Property ID information, Geographic ID information an a legal description of the tract. In some cases, “land” will be comprised of several tracts with different property identification numbers, so make sure to include the legal description for all tracts of land for which an application is being made.

If you recently purchased land for which you are making application, you will need to refer to the documents you received at or shortly after closing on the property. Another option for collecting the legal description of a property is to look up the property on the CAD’s web site under the prior owner’s name. It can sometimes take while before the CAD updates the information within their site.

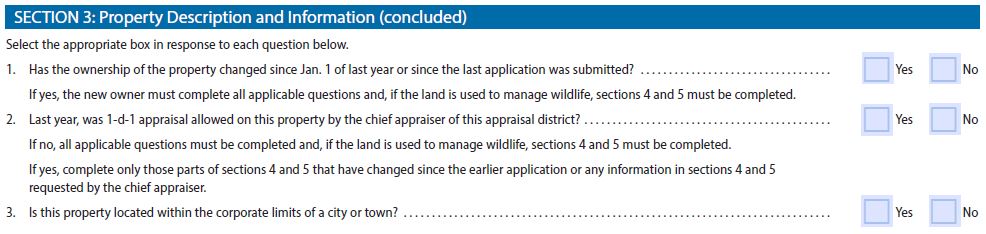

50-129 Instructions for Section 3 (Concluded)

Section 3 (concluded) has a series of straight-forward questions. Answer all three questions and notice that second question points out for those switching to wildlife management use must also complete sections 4 and 5. The answer to question 2 must be “Yes.” This is especially important if you intend to switch from a traditional agriculture tax valuation to wildlife management use (wildlife tax valuation).

Application Instructions for Section 4

Section 4 is one one the larger sections in Form 50-129, but it can be navigated by following these instructions. Keep in mind that agricultural use includes, but is not limited to, cultivated crops, horticultural activities, raising or holding livestock, raising or holding exotic animals, timber production, beekeeping (for honey production) and wildlife management.

It’s important to note that wildlife management is defined as actively using land that at the time wildlife management use began (i.e. Section 3, question 2), was appraised as open space (1-d-1) to sustain breeding, migrating or winter population of native wild animals for human use, including food, medicine or recreation, in at least three of the following ways, 1) habitat control, 2) erosion control, 3) predator control, 4) providing supplemental supplies of water, 5) providing supplemental supplies of food, 6) providing shelters, and 7) making census counts to determine population.

Property owners converting land from traditional agriculture to wildlife management use must also include with Form 50-129 a wildlife management plan that identifies the native wildlife that will be targeted for management and identifies at least 3 management practices that will be implemented on the property. The management practices must meet the intensity requirements for the wildlife appraisal region and the size of the property.

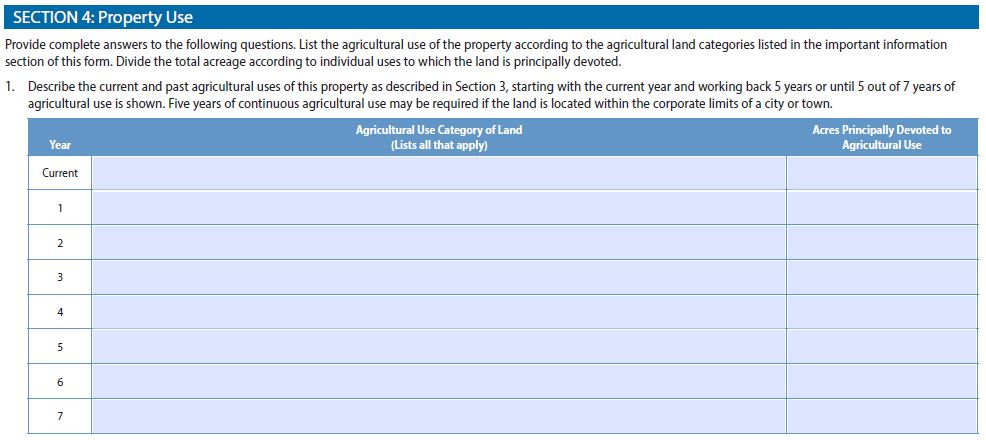

Part 1 of Section 4 is used to determine whether or not the property has been in agricultural use (or has established agricultural use) so that the CAD can determine if the property can remain in agricultural use. In Texas, a property can achieve or maintain ag use if it has been in agricultural use for at least 5 out of the past 7 years.

For land to qualify for special appraisal as wildlife management use, the land must have qualified for special appraisal as open space or timber land under Subchapters D or E of Tax Code Chapter 23 at the time the wildlife management use began (i.e. had an ag tax valuation the year prior). In short, a property that was appraised as open-space (1-d-1) land the year prior can convert to a wildlife tax valuation as long as the property meets the general use requirements and files Form 50-129 and a management plan with the CAD during the annual application period, January 1 through April 30.

Part 1 of Section 4 ask you to list the agricultural use of the property by year according to the agricultural land category, starting with the current year and working back in time. The last page of Form 50-129 is titled “Important Information” and list the common agricultural land uses:

“Agricultural use includes, but is not limited to, the following activities: (1) cultivating the soil; (2) producing crops for human food, animal feed, or planting seed or for the production of fibers; (3) floriculture, viticulture and horticulture; (4) raising or keeping livestock; (5) raising or keeping exotic animals or fowl for the production of human food or fiber, leather, pelts or other tangible products having a commercial value; (6) planting cover crops or leaving land idle for the purpose of participating in a governmental program provided the land is not used for residential purposes or a purpose inconsistent with agricultural use or leaving the land idle in conjunction with normal crop or livestock rotation procedures; (7) producing or harvesting logs and posts used for construction or repair of fences, pens, barns or other agricultural improvements on adjacent open-space land having the same owner and devoted to a different agricultural use; (8) wildlife management; and (9) beekeeping.”

Property owners converting to a wildlife tax valuation need to enter the year that the application is being made into the cell that reads, “Current.” If the application is for the year 2022 then simply write in “2022.” In the next column to the right, the applicant will then need to write in “Wildlife Management” under the heading labeled “Agricultural Land Use Category of Land.”

In the far right cell, the applicant should then write in the amount of acreage that will be devoted to wildlife management under “Acres Principally Devoted to Agricultural Use.” This will usually be the entirety or most of the acreage, except any portion of the property that is already appraised another way, such as residential or commercial use.

Next, in the row below with a “1” in upper-left part of the cell, the applicant must write in the calendar year prior. In this example we are applying to convert ag or timber land to wildlife use for year 2022, so the applicant would write in “2021.” Then, just as the first row, write in the appropriate agricultural or timberland use and the amount of acreage that was devoted to ag or timber use.

Technically, because of Texas Tax Code 23 this enough apply for wildlife management use; you can leave the remainder of the rows blank. However, some appraisal districts like to see property owners list the ag use of the land at least 5 years prior to the application year. Work backwards in time by year and list the ag use category. For most, the use category will likely be “Raising or Keeping Livestock” for years prior to converting to wildlife management.

If applying for an agricultural tax valuation for a property that does not currently have an ag tax valuation, then the applicant must enter enough years (at least 5, but up to 7 years) until agricultural use is demonstrated during at least 5 of the past 7 years.

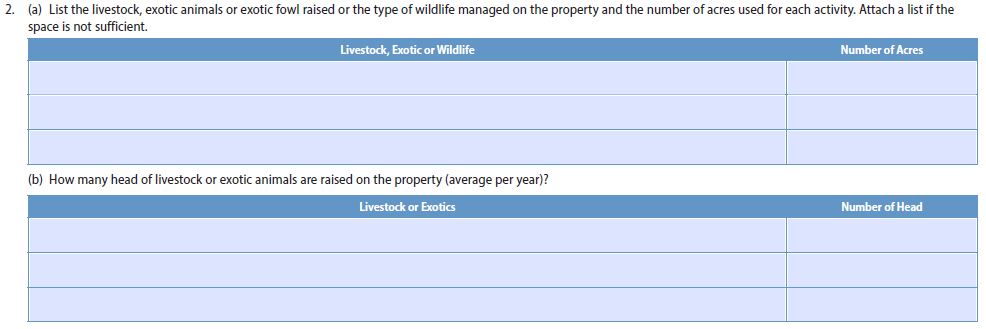

If converting land to wildlife management use, then the only other part of Section 5 that needs to be completed is Part 2 (a). This part ask that the applicant to, “List the livestock, exotic animals or exotic fowl raised or the type of wildlife managed on the property and the number of acres used for each activity,” and then to list the “Number of Acres.” This is straight forward.

In the cell under “Livestock, Exotic or Wildlife,” enter the specific wildlife species or group that you will be managing for on the property. Write in “Songbirds” if managing for songbirds, or “Doves” if managing for doves. If managing for two groups, then write in both groups. This should line up directly with the wildlife management plan for your property. In the cell to the right it once again asks for “Number of Acres.” This should reflect the same acreage listed under “Acres Principally Devoted to Agricultural Use” in Part 1 of Section 4.

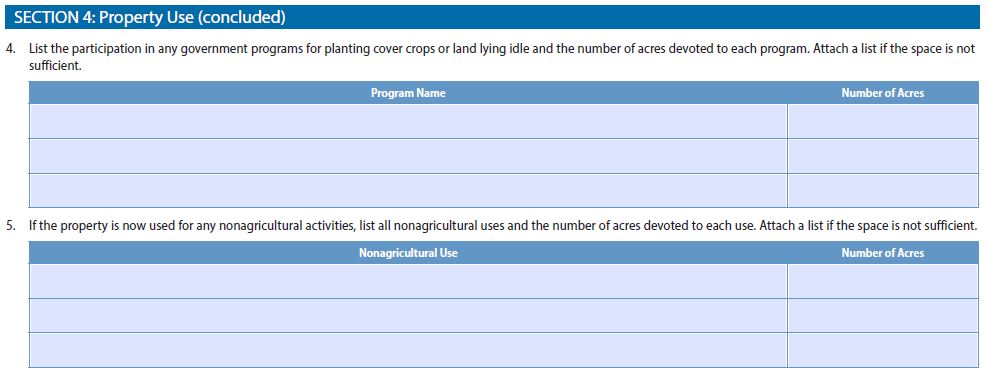

The remainder of Section 4 is only for property owners applying for a standard ( agricultural tax appraisal/valuation (farming, ranching, etc.). If the applicant is applying for wildlife use then parts 2(b), 3, 4, and 5 of this section can be left blank, unless other land uses are planned for parts of the property, in which case the appropriate parts should be completed.

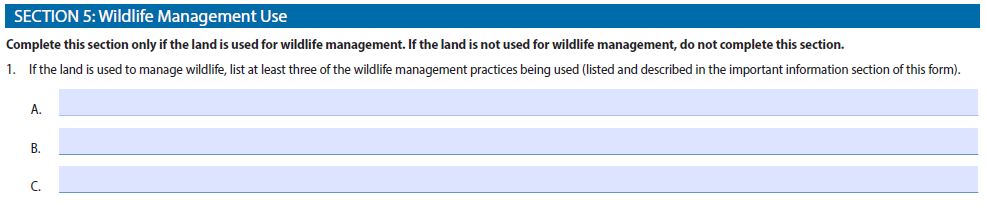

Property Tax Form 50-129 Instructions: 5

One of the requirements for maintaining an agricultural appraisal on a property through wildlife management use is active management of the property. The guidelines require that at least 3 management practices be carried out annually of the property. Section 5 is where you tell the CAD which three wildlife management practices will be implemented on the property.

An applicant may enter more than one practice per line if the plan is to do more than three practices on the property, if you want to get it all in there. Otherwise, simply enter at least three practices that will take place on the land that benefit the native animals selected for management. For example, row A may have “Habitat Control,” row B may have “Supplemental Water” and row C may have “Supplemental Shelter” if these are the practices listed in your management plan.

Part 2 of this section ask for the applicant to list the property’s agricultural land use category for the tax year preceding the land’s conversion to wildlife management use. The categories are listed in Section 4 and include 8 main categories. Again, for Section 5, #2, most will need to write in “Raising or Keeping Livestock.” If unsure which accurately describes the property, check the property within the CAD’s web site using your name or the name of the previous property owner.

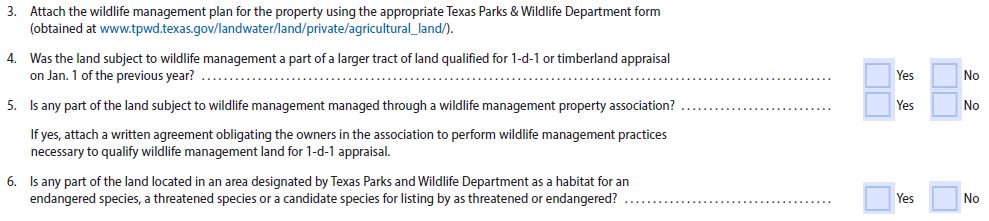

Parts 3 through 8 includes a series of yes/no questions, totaling 10 questions in all. For question 3, “Yes” must be checked if the property is being converted to wildlife management use. It’s asking if a wildlife management plan on state form PWD 885 has been completed. We have provided this you with this form if we have prepared the management plan for your property.

Question 4 is trying to determine whether or not the property was part of a larger tract of 1-d-1 land the year prior. If so, then the property may be subject to a minimum acreage requirement. If we have prepared a management plan for you, then your property has been vetted as large enough to qualify. In many cases the answer to question 4 will be no, but if the property was cut out of a larger tract then answer yes.

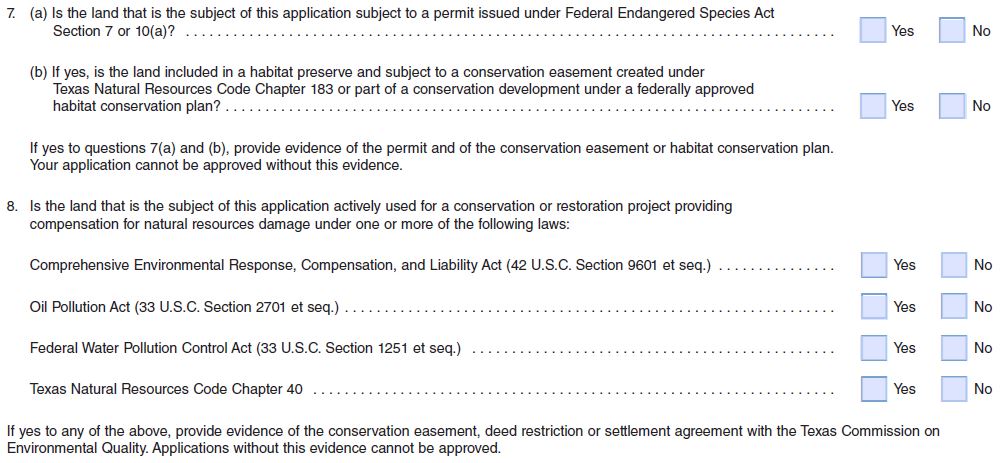

The answers to the remainder of the questions (5-8) will most likely be no, but make sure to read them all just to be sure. Answer “no” if you are not sure.

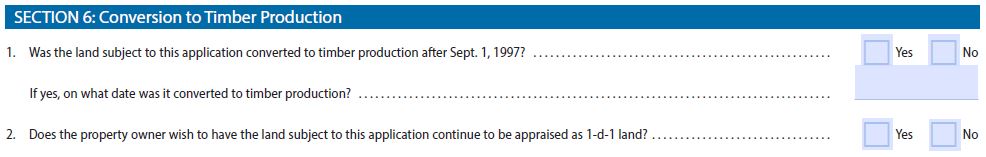

Texas Form 50-129: Section 6

This section is very specific and the first question is related to timber production. Most will answer no, but if the answer to the question is yes then a date must be entered, as well. This question is inconsequential if you are converting timberland to wildlife management use, so there is no hazard in answering no if you really don’t know.

The second question asks, “Does the property owner wish to have the land subject to this application continue to be appraised as 1-d-1 land?” You want to check “Yes” as this is the reason you are completing this “Application for 1-d-1 Agricultural Use Appraisal.”

Form 50-129 Instructions: Apply for 1-d-1

Congratulations, you have made it to the final section of the form! It’s also without doubt the scariest section, but you have nothing to worry about as long you have not knowingly made any false statements.

The last part of this document includes printing your name, then signing and dating the application.

This concludes our journey together through the 4 pages that comprise Form 50-129. Kind of a waste of paper, right? We hope these instructions helped you fully complete your Application for 1-d-1 (Open-Space) Agricultural Use Appraisal, but if you have any questions at all, please feel free to contact us. We hope you enjoy managing for wildlife on your property.